Google’s the industry standard in entity-relationship recognition. And as it’s added (and gotten better at) more SERP features, often a lot more is revealed and we can use these as better research tools.

The fun thing about “People Also Search” (PAS) is that it’s a potentially rich source of relationships, and relationships are a rich sources of actionable data, revealing networks, measures of influence, unlocking predictions, yada.

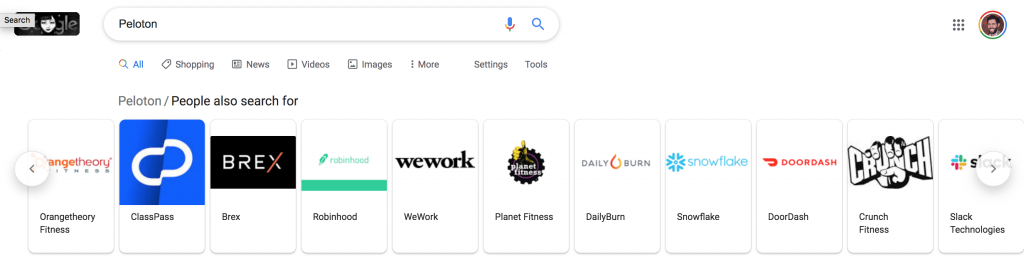

So I was working on a (overdue) post on the Peloton thing, and in running a search to see how there stock was doing these days, this popped up:

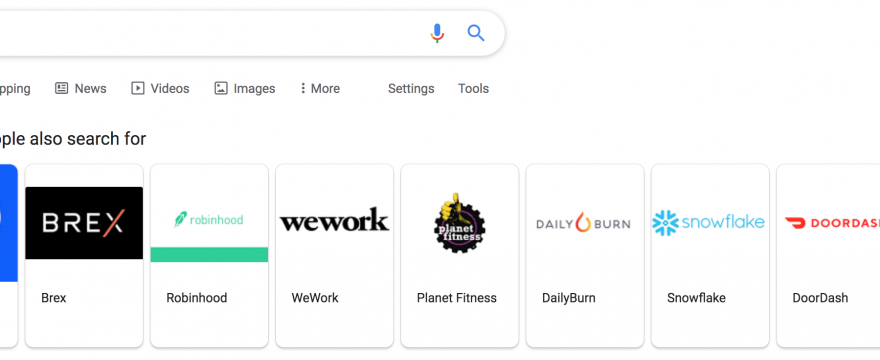

If you can’t see, its the “People also search for” companies associated with Peloton. It also shows up intermittently on brand searches. To get to it, you can often click a “People also search” thumbnail item under the knowledge panel on the righthand side of the SERP.

This took me down quite a rabbit hole of thinking around PAS, so here it is:

PAS for competitive research

This is perhaps the most obvious. But there are still potentially some nuggets for organizations that don’t have a lot of direct competition.

If you have a Peloton bike, you could also go to Planet Fitness. But if you’re making a change for, say, the new year, those can become competing considerations.

Same with ClassPass (membership subscription for a network of gyms in a metro area). I wouldn’t have thought, “one of Peloton’s competitors is ClassPass,” but can certainly imagine competition between those services for those seeking class variety.

Clustering the fitness related results we see some patterns we can use to better structure a competitive analysis.

I’m imagining more of a fitness stack unfolding here or buckets of indirect competition to consider – boutique fitness studios, gyms with classes memberships, and tech driven fitness apps.

- DailyBurn (app, online classes, app)

- ClassPass (app, multi-gym subscription, classes)

- Orangetheory (membership, tech enabled classes)

- Fitness club (gym + classes + membership)

- Crunch Fitness

- Planet Fitness

- GoodLife Fitness (Canada)

- Nuffield Health (UK)

Search intent breakdown

Previously, you had to run ads or rank for a key term to get some sense of the mix of intent. And even then your clicks run through the filter of whatever relevance you might have to the search, where a high CTR might be 15%.

As I was explaining to a client last week, just because “mausoleums,” gets 40k searches a month doesn’t mean even 1% of those people are in the market for one.

If we assume “People also search” provides some hints as to the breakdown of intent and we ignore the nose stuff, like “fitness alternatives,” for a minute, we can find more interesting things.

So I started sorting non-fitness PASs associated with Peloton:

- work: WeWork, Zoom, Slack

- food: DoorDash, Instacart, Uber, Beyond Meat

- comsumer (misc): Roku, Warby Parker, Compass, Uber

- tech (misc):

- Palantir (big data analytics software)

- Brex (business credit cards for tech companies)

- Snowflake (data-warehousing)

- Samsara (AI driven industrial IoT)

My initial temptation was that this is starting to feel like a buyer profile, right? A magical way to unlock the tastes of those interested in Pelotons and the other types of things they search for – you know, if we can assume people searching Peloton have some commercial search intent.

To investigate further, I ran some searches on “Peloton” + <PAS Company name> to see if there were other relational considerations that might explain whey these are getting lumped together.

For one, the tech startup cluster is probably related to some mix of investing research and associated entities. For example, an Inc article listed Slack, Peloton, and Palantir for 2019 IPOs.

Another Inc article listed these as “best places to work:”

- Snowflake

- Dosist

- Samsara

- DoorDash

- Brex

- Good American

- Robinhood

- Peloton Interactive

- Compass

- Nuro

Seven of the 10 are in our PAS. Interesting, right?! And searches on things like “peloton samsara” revealed a Pathrise “working at Peloton vs <company>” type comparisons.

Update: It looks like that list was sourced from this original LinkedIn best places to work list. Google is applying major entity relationship signals from authoritative list content to inform “People also search” feature. But I digress.

So now we have some signals of search intent as:

- product research (can inform competitive analysis)

- alternative intent breakdown (job research and investment or tech startup news type research can inform a brand’s content strategy – better enabling them to own their story so to speak or map user journeys more effectively )

Both pretty big chunks of non-commercial search intent.

What about personal brand research?

I think this all still holds pretty well. As long as your personal brand has a threshold of visibility and is a recognized entity, PAS can be a pretty worthwhile starting point for competitive research and potential partnership brainstorming.